TIMELINE-Diary of a meltdown: how the Archegos Capital fire sale went down

This is the beauty of a SeeTheDollars diagram: it summarizes the whole article with one picture.

Click on the three buttons below the Money Pump sequentially, from top to bottom, to follow the timeline. The last button visualizes dishonesty.

The MY STORY page describes how SeeTheDollars was developed.

And now, on to the story of the fire sale. A story of human drama played out in the financial world.

In 2013, Bill Hwang, an investor from South Korea, started the family office called Archegos Capital Management to take care of his personal finances. A family office is not required to report the stocks it trades. That kept Archegos away from the scrutinizing eyes of Wall Street and the Regulators and gave Hwang considerable freedom to do what he wanted to do, without having to account for his actions to anybody.

The name Archegos comes from the Greek word αρχηγός, which means leader. The word has been around for centuries in Greece and it’s very common today. For example, you would ask a high school guy: "who is the αρχηγός of your soccer team?"

Bill Hwang didn’t want to bother buying and selling stocks. That wasn’t his cup of tea. But he did want to gain the benefits of stocks, when the price was going up. It so happens that there is a method on Wall Street to allow someone to do just that and it’s called Total Return Swap.

In a Total Return Swap, you agree with someone who owns the stock you are interested in, like a bank for example, to let you have exclusive rights to any financial gains the stock creates in return for paying the bank a certain amount of money. It’s a gamble. When the value of the stock goes up, it is definitely a good deal because you benefit from the stock without having to buy it. But when the stock loses value, you should have cash set aside to pay the bank the amount specified in the agreement.

When you deal with Total Return Swaps, your name does not appear anywhere as the owner of the stock, because you are really not the owner. You operate in total anonymity. And when you are making money without actually owing anything, you may feel like you are making money off thin air. That feeling, combined with the anonymity, may encourage you to become greedy, which is what happened to Hwang.

Let’s now get into specifics.

Archegos was particularly interested in the stock of the media company ViacomCBS. You can follow its value using the Wall Street symbol VIAC, like I did.

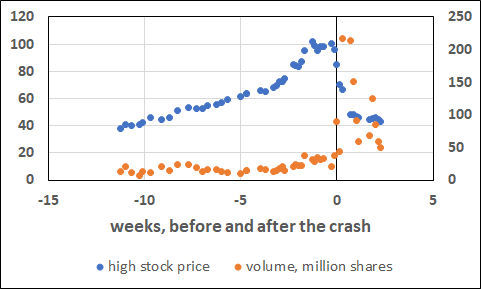

Look at the value of the stock on Chart 1 shown in blue. For four months before the crash the price of the stock had a spectacular growth, going from 40 to 100.Then, a week before the crash, it leveled off. The day of the crash, which I call day zero, is indicated by a vertical line and it was Wednesday, March 23, 2021.

Chart 1

A lot of people must have made that observation, but there are two who are relevant to this story. One is Bill Hwang and the others are the executives at ViacomCBS. Each had a different motive and each reacted differently.

Bill Hwang wanted to make money so he decided to seize the moment. As the stock was going up, he borrowed to the hilt to gain access to more and more stocks. He made Total Return Swap deals with a lot of banks, but he kept each bank in the dark about what he was doing with the others. No single bank knew that Bill Hwang was making the exact same deal for the exact same stock with a lot of other banks. If the banks knew that, they would have probably looked into the situation that appeared a little out of the ordinary. I assume that Hwang was fixated on the growth and he didn’t pay much attention to the stock leveling off.

The executives at ViacomCBS were following both the growth and the leveling off because they were planning for some time to make a $3 billion offer for a new stock to raise money to finance a streaming video venture to compete with Apple TV, Netflix and others. Obviously, they wanted the value of the stock to be as high as possible when they made the offer. So, I think, when the stock leveled off, they were debating whether to wait for the stock to rise again even more or proceed with the plan at the current price. The current price was not too bad, being about three times what it was a few months ago, so why risk it? They thought about it for a week and decided this was the right time to go ahead with the plan.

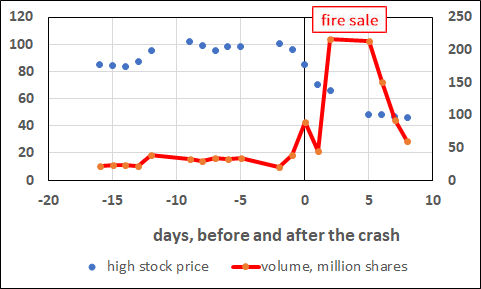

Look now at Chart 2, which has the same data as Chart 1, only zoomed in around day zero and the volume is emphasized in red.

Chart 2

On the Monday before day zero the stock had leveled off for the whole previous week, as you can see from the five blue dots on the chart. So, after the stock market closed for the day, ViacomCBS announced that it was issuing new stock to raise $3 billion.

Apparently, investors were not that thrilled with this idea and started selling the stock, causing the price to go down a little on Tuesday. Perhaps they thought that ViacomCBS could not pull it off and compete with the likes of Apple TV and Netflix. But the worst thing happened on Wednesday, when the stock price fell even more. That’s when all hell broke loose.

All hell breaking loose means that the banks demanded cash from Bill Hwang to cover their losses and Bill Hwang didn’t have it. The technical term for the banks asking Bill Hwang to cover the losses is “margin call.”

As the red line shows, it took the banks two days to digest the shock before figuring out what to do. And on Friday, the fire sale started. The banks were selling like crazy to avoid more losses, as the stock was going down. You can see that on the red line on the graph when the volume increased five times on Friday.

To get an idea of the magnitude of the fire sale, here are some numbers. Goldman Sachs sold more than $10 billion of stock, Morgan Stanley $8 billion and Deutshe Bank $4 billion. Credit Suisse and Nomura hesitated a little before selling, and by then the stock went down considerably, causing them large losses.

That’s a lot of money, puff, up in the air, don't you think?

This is the end of the sad story of a $20 billion collapse on Wall Street.

And this is the beginning of thinking - for me, at least.

For sure, the story of the fire sale is interesting. But for me, comparing my finances to all that money changing hands in just a few days is more important, because they trigger questions like: Where did all these billions of dollars come from? Who bought the worthless securities? How did the bank customers get affected by the fire sale?

SeeTheDollars has a feature that can be used to answer questions that come up from watching the Flying Dollars on a money flow diagram. It is called “Expand the Discussion” and can be used to follow the money trail beyond the boundaries of a diagram. In a true SeeTheDollars way, the answers would be presented to you as money flow diagrams attached to the original one. This feature is described on the page called Expand the Discussion, which is part of the Visual Draft of the Requirements Specification Document.

That is the true meaning of making the economy easy to understand: you become a critical thinker.

Before I close this narrative, I would like to add one more thought, which I think is important.

When the application SeeTheDollars is developed, people can use it to create their own illustrations all by themselves. Each person may have their own reasons, but I can think of an important one right now myself.

It is very common in Congress, when it’s time to vote on an appropriations bill, meaning how to spend money they probably don’t have, that the text of the bill, which could be, say, one thousand pages long, to be distributed to the Representatives one or two days before the day of the vote. I don’t know of anyone of them who has ever read the whole bill before the vote; it’s humanly impossible. So, they vote on it blindly, without having a clue who gets what and how much, while at the same time they complain that they didn’t have time to read the text.

But if the text was summarized with SeeTheDollars money flow diagrams, they could quickly see who gets what and how much and they could not have that excuse anymore. Also, anybody would be able to see the illustrations, if they were put on a government website. That's true transparency.

SeeTheDollars, bringing budget and deficit discussions to all, cool, eh?

References

I visualized the article TIMELINE-Diary of a meltdown: how the Archegos Capital fire sale went down by Elizabeth Dilts Marshall, Matt Scuffham that appeared here.

For some more detailed background information I used the article Bill Hwang Had $20 Billion, Then Lost It All in Two Days, The fast rise and even faster fall of a trader who bet big with borrowed money by Erik Schatzker, Sridhar Natarajan, and Katherine Burton. that appeared here.

You can follow the price of the ViacomCBS stock, under the symbol VIAC, here.

For a definition of the Total Return Swap, with examples, go here.

For a definition of the Margin Call, with examples, go here.